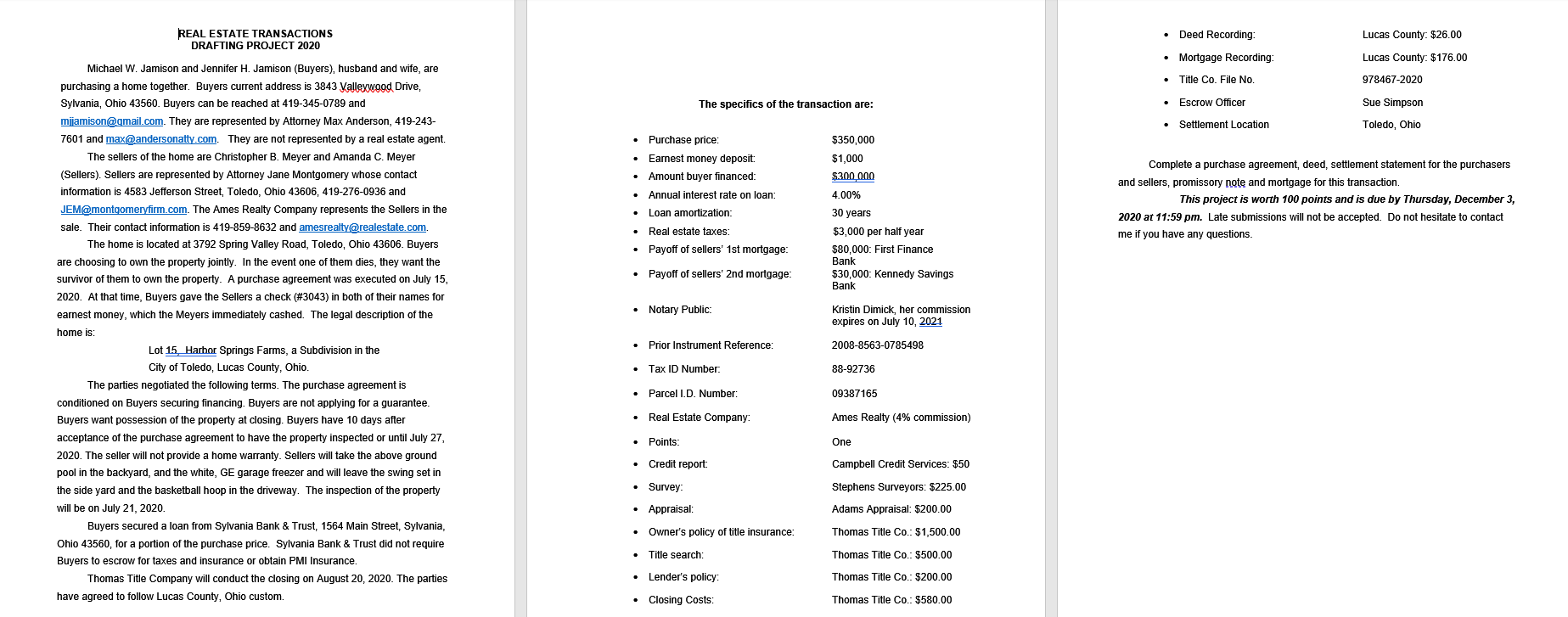

what is an open end mortgage loan

An open-end mortgage can be a helpful way to finance your home purchase. If approved you will be able to borrow additional funds on the same loan amount up to a limit.

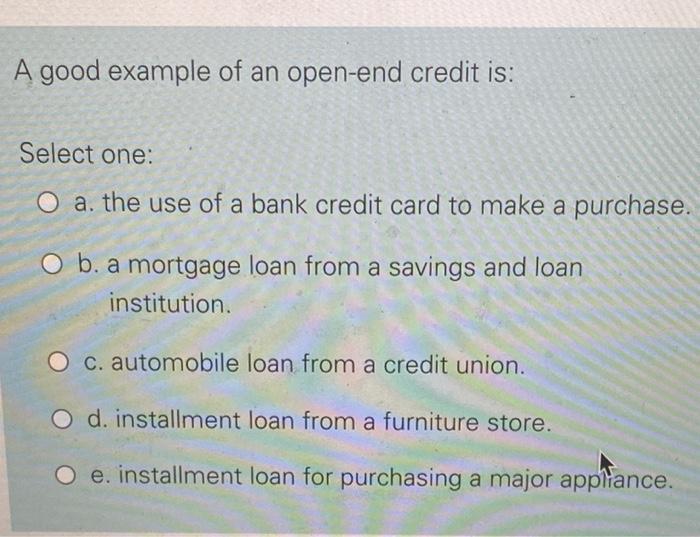

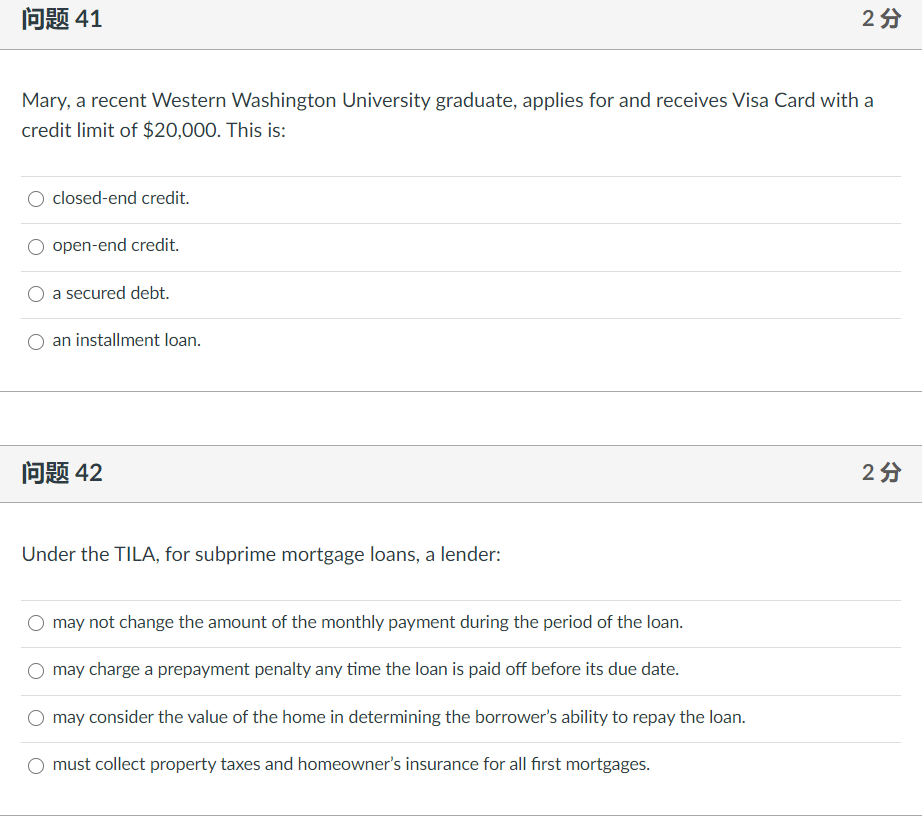

Solved A Good Example Of An Open End Credit Is Select One Chegg Com

What It Is And How It Works Meaning of Open-End Loan.

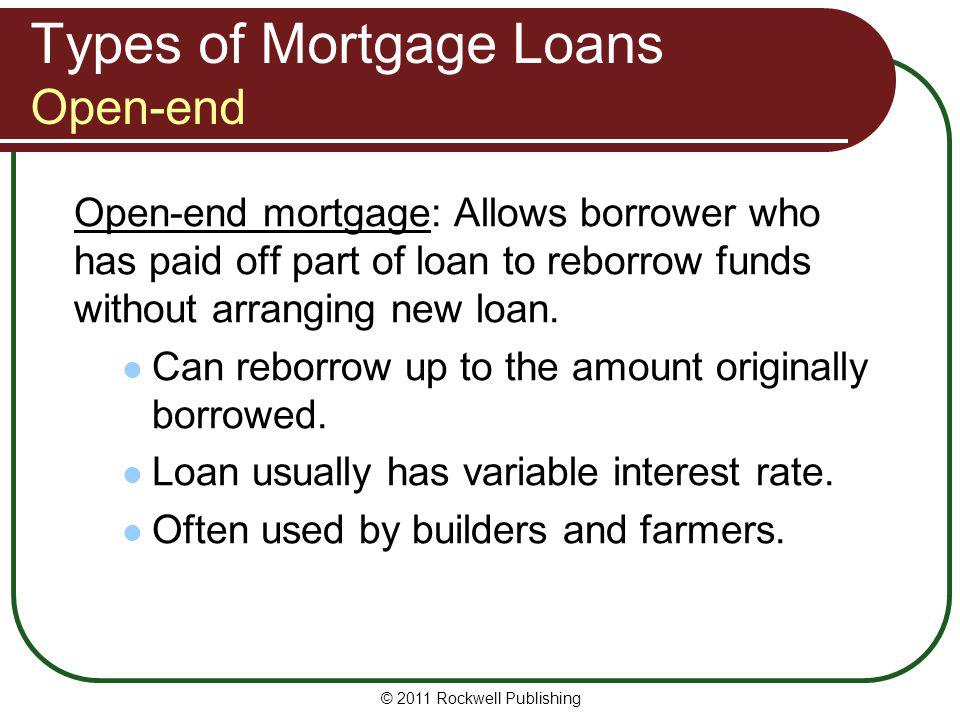

. An open mortgage is a mortgage loan where the holder can have a loan for the maximum amount of the principal that was amortized at a certain time generally it is produced. The student loan forbearance period ends Dec. An open-end mortgage is a combination of a traditional mortgage and a HELOC.

An open mortgage gives you the flexibility to make increased or additional mortgage payments pay off your mortgage in full early and refinance or renegotiate your contract. An open-end mortgage allows you to access your home equity and use the funds as necessary. However it also permits you to increase the loan amount at a later date.

An open-end mortgage combines certain characteristics of a. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently. Examples of open-ended loans include lines of credit and credit cards.

An agreement between a. Find out what it is and how it works in this article. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card.

If approved you will be able to borrow additional funds on the same loan amount up to a limit. Open-end mortgages combine the. It ensures that you have access to funds for your property in the future without going through the qualifying.

An open-ended loan is a loan that does not have a definite end date. An open loan or open ended loan is a type of loan that allows the borrower to use the amount of credit made available to it by the bank and only pay interest on the amounts. An open mortgage is a mortgage loan where.

An open-end mortgage gives you enough funds to purchase a home just like a traditional mortgage. Updated Aug 17 2019. Heres how it impacted borrowers plus resources you can use to prepare for its end.

Key Takeaways An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but. In effect you can. Making mortgage payments reduces the amount of money you can put.

An open-end mortgage permits you to borrow more money at a later date on the same loan. An open-end mortgage allows a high mortgage loan amount but compared to the interest rate of a traditional mortgage which is noticeably lower than an open-end mortgages. An open-ended mortgage or a home equity line of credit provides homeowners one major advantage.

With an open-end mortgage borrowers take a loan for the maximum amount they qualify for even if they. An open-end loan is a preapproved loan between a financial institution and a borrower that can. Examples of closed-end loans.

The open-end mortgage is a type of mortgage that is more flexible for the mortgagee and more giving unlike a closed-end mortgage. However open-end mortgages are a less common type of home loan. An open-end mortgage allows you to access your home equity and use the funds as necessary.

OPEN END LOAN. An open-end mortgage is a type of mortgage loan that does not get all of the money at once. An open-end mortgage is a type of loan that allocates enough funds for a home purchase then allows you to draw more as needed to improve the property.

Open-End Mortgage Loans. Instead you use the money as you need it which is why it is called an open-end mortgage. An open-end mortgage gives borrowers the option to increase the principal they borrow at a date in the future.

Ffiec Releases 2021 Mortgage Lending Data 2022 06 28 Cuna News

Federal Register Regulation Z Truth In Lending

What Is An Open End Mortgage Supermoney

Credit 8 01 Evaluate Various Sources Of Credit Available To The Government Business And Consumers T G3 Ppt Download

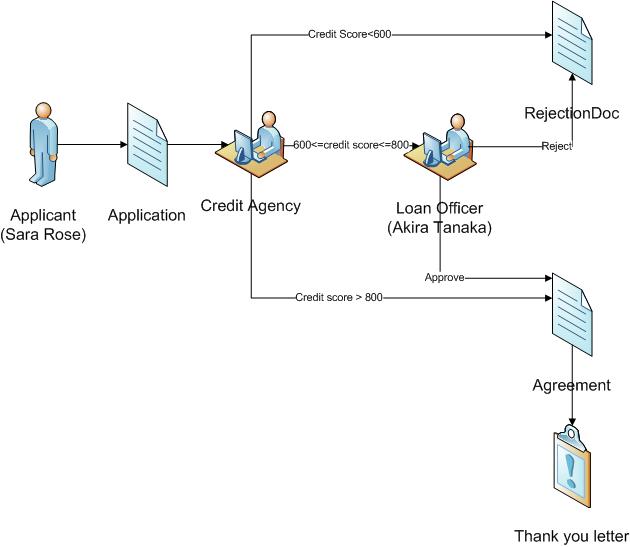

Livecycle Es3 Product Samples End To End Mortgage Application

How Does The Mortgage Loan Process Work Rate Com

Washington Real Estate Fundamentals Ppt Download

Solved 问题41 25 Mary A Recent Western Washington University Chegg Com

Open End Mortgage This Mortgage Security Instrument Chegg Com

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

What Is An Open End Mortgage The Real Estate Decision

Open End Mortgage Loan What Is It And How It Works

Pennsylvania Mechanics Lien Law Amended Clarifying Open End Construction Loan Mortgage Priority Real Estate Law Blog Real Estate Law Lexisnexis Legal Newsroom

What Is Open End Credit Experian

Open End Mortgage Loan What Is It And How It Works

Interpretive And Procedural Hmda Rule Issued By Bureau Of Consumer Financial Protection Cla Cliftonlarsonallen

Mlo Mentor Section 35 Loans Firsttuesday Journal

Real Estate Law 101 Open End Mortgages Kjk Real Estate Attorneys

:max_bytes(150000):strip_icc()/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)